I think the hardest way to invest is buy and hold. It might not seem that hard because you just buy a stock or a piece of real estate and let the income roll in for years on end. No need to worry about selling. I say it is the hardest though because of the mental aspect. You have to sit through large market corrections and watch the value of your investment dwindle while telling yourself that this too shall pass. It is hard to hold onto an investment while everyone is selling into the market decline. Humans move in herds so you have to think differently. Be a contrarian. It takes courage.

Buy and hold investing is also boring. Humans naturally want action. Hence why we get a thrill from gambling. Sitting on your ass and watching your investments is not fun. It is like watching paint dry.

So, does buy and hold investing produce investing results that more than compensate for the mental anguish of price declines and sitting on your ass?

Absolutely.

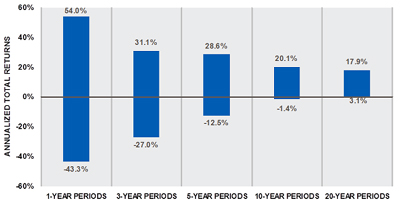

Charles Schwab conducted research to determine the annual returns for various holding periods. They looked at the period from 1926 to 2011. What they found was that the longer you hold an investment, the less chance of negative returns. As you can see from the chart below, a 20 year holding period never produced a negative result! As noted below, holding for 10 years or less can produce a negative return if you sell at the wrong time or try to time the market.

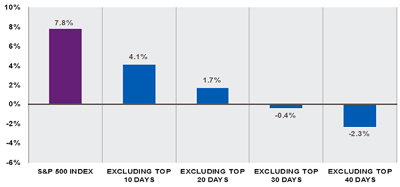

Schwab also looked at how market timing can impact your returns. What they found was that market gains are only made over so many days. As you can see from the chart below, if you were out of the market for the top 10, 20, 30, or 40 days of gains, your returns were much lower than the returns for the S&P 500. So this shows that timing the market is hard because returns are concentrated in such short periods of time. If you tried to time the market over this period (1926 to 2011), missing these few days was pretty much a certainty. Buy and hold prevails.

So are there any stories of people who actually became really wealthy by buying and holding? There certainly are.

Grace Groner, a secretary at Abbott Laboratories purchased $180 of the Company’s stock in 1935 and died in 2010 with an estate valued at $7M! She never sold the stock and reinvested the dividends. She lived modestly and nearly all of her wealth was in Abbott Laboratories stock on her death. She left her money to charity.

Ronald Read amassed an $8M fortune on a janitor’s salary! He did it by buying stocks and holding onto them forever. He owned 95 stocks at the time of his death. He gave away a substantial portion of his wealth to his local hospital and library on death.

Lawyer, Jack MacDonald, accumulated a $188M fortune that he left to charity on his death at 98! How did he do it? Buy picking stocks and holding them for the long-term.

There is the story of the Coca-Cola millionaires from Quincy, Florida. These people bought shares of Coca-Cola in the 1920’s and 1930’s and held onto their shares (and bought more) through the Great Depression. At one point, Quincy was the single richest town per capita in the US.

Buy and hold investing works in real estate too. The other day I came across a house in Toronto that had been purchased in 1966 for $10,000 and sold for over $1M! If the house had only increased at the rate of inflation, it would have only been worth $73,000 today. I think the $1M price tag is absurd but even if the house is worth half of that, it shows that buy and hold investing can work in real estate. You can see that same result in places like Vancouver, San Francisco, New York, and Seattle where people purchased decades ago and are now sitting on large inherent gains on their real estate.

Clearly buy and hold investing can work. The keys to achieving vast wealth using buy and hold investing are:

– Be frugal when young and sock away money for investing. Time is your friend. This maximizes compounding. $1 put away by a 20-year old earning 10% per year (average annual stock market returns over the last century) will have $45.26 by the time he is 60.

– Try to invest as much money as possible at a young age to build as big a snowball as possible.

– Perform your due diligence up front and pick great companies or a solid piece of real estate.

– When markets are down, buy more. Add to existing investments or buy new bargains. Buy when others are running for the exits.

– Be skeptical when stocks are overvalued. Proceed with caution. Don’t mind holding extra cash when there is significant overvaluation.

Great post! I enjoy reading your blog! I would like to add a few point to the buy and hold strategy. I agree with you. People want action and in stock investing you might not be able to get that. But in real estate investing, there are plenty of actions!

As a real estate investor, I don’t think buy and hold is boring when it comes to REI but you have to really enjoy being a landlord and learning about REI for it to be interesting :). Also, appreciation gain is only one of the ways to make money in REI. There are also cash flow, principal equity pay down, tax benefits to name a few that makes real estate investing even more interesting. Thank you for sharing this! Looking forward to your next post 😉

LikeLike

I absolutely agree with you on real estate investing. It is definitely more involved than investing in stocks which can make it more fun. I think using leverage in real estate investing can also magnify your returns more than it would in forms of investing. Thanks for dropping by.

LikeLike

Great post. I think you may also want to touch on the types of companies these are. As a dividend growth kind of guy I prefer companies that pay me to own them. Individualized stock picking can also be risky because you put all your risk in one or two stocks so individuals who don’t want to do the research would be better served with mutual funds.

LikeLike

I agree. If people are not up to do research, they should look at index funds or ETFs. As for individual stock picking, I think if someone does their research and spreads risk over a number of companies, they can adequately diversify – you have to be able to stomach volatility though.

LikeLike